☕DRep Double-Espresso Dispatch

#3 – June 9th 2025 | A cup of fast, strong governance and budget intel—brewed especially for DReps.

Welcome to the DRep Forum Newsletter

The purpose of this newsletter is to reduce noise and increase signal - offering DReps a neutral, fast-read view of Cardano governance. We’re not here to tell you what to think, but to help you keep up to speed with what others are thinking, across the board.

TL;DR – Five Things to Share This Week

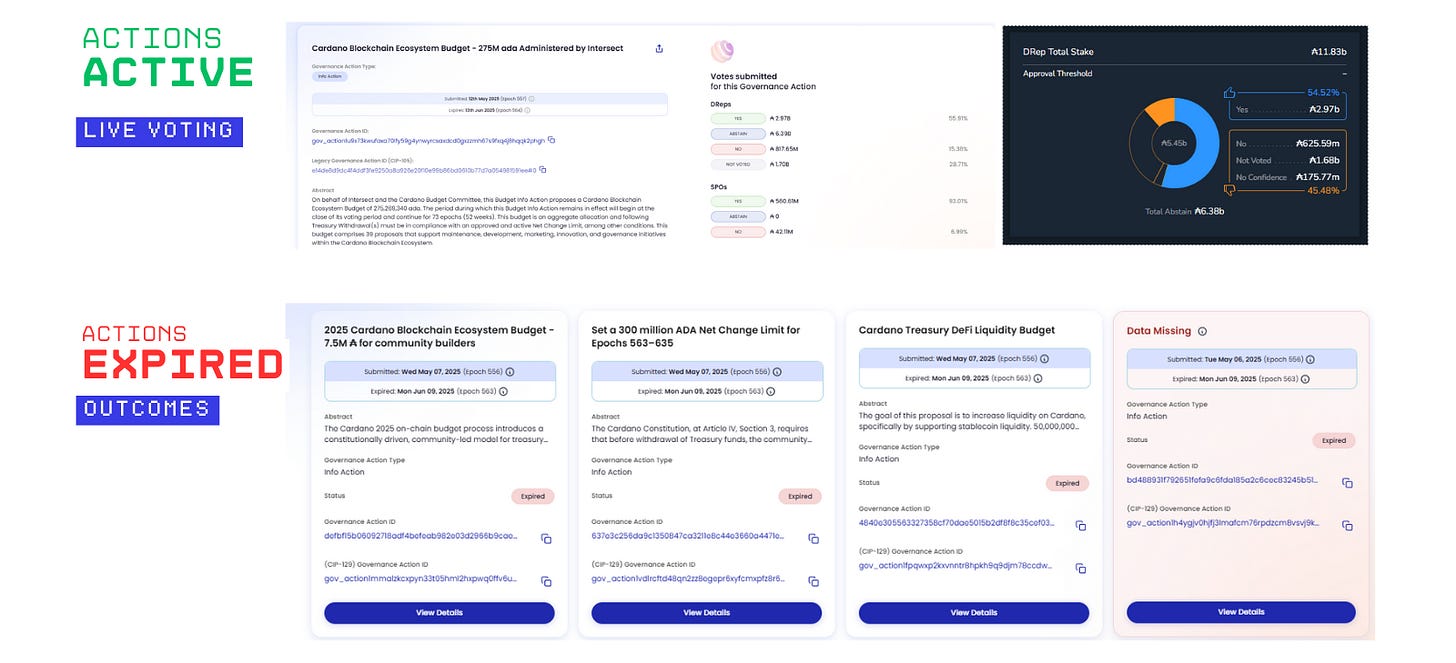

₳275M Budget Info Action Vote Open - Ends June 13. DReps are voting on Intersect’s budget proposal to fund 39 ecosystem initiatives. This is the only active governance action; others have expired. This is a signal vote, not a disbursement.

24 Hours Left: Treasury Withdrawal Poll Closes Today. This is a non-binding temperature check, not a governance action. DReps are also weighing in on how to structure Treasury withdrawals to support Intersect decision making. Option E (39 individual withdrawals) currently leads, but would come with operational trade-offs if fully implemented.

Most Treasury Proposals Didn’t Pass. Only two governance actions passed, Amaru Node (80.43%) and the ₳350M NCL cap.

Constitutional Committee (CC) Elections Go On-Chain. Voting will be DRep-based, using hot/cold wallets or CLI. More info here.

Charles AMA: Highlights Missing Executive Function. Hoskinson flagged Cardano’s lack of an “executive branch” as a challenge to strategy and roadmap coordination. He suggested the community may need to delegate limited execution authority for strategic clarity and to avoid delays.

🔔 Reminders: Governance Action Timelines

🚨 3 DAYS LEFT! Cardano Blockchain Ecosystem Budget - 275M ada Administered by Intersect → Review

And as a reminder the governance actions that have passed so far…

PASSED AT 80.43% - Amaru Node Development 2025 proposal who are also at @Amaru_Cardano on X

PASSED AT 73.35% - 350M ada Net Change Limit

When Off-Chain Signals Hit On-Chain Stakes

So what’s been happening?

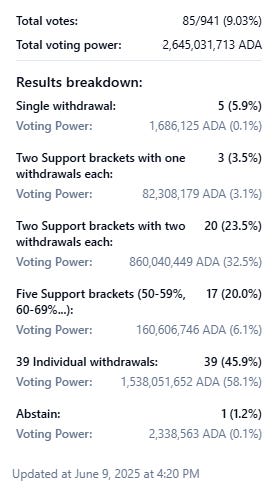

Intersect (Cardano’s member-based org) is running a non-binding poll on Ekklesia to understand DRep preferences on how to proceed with 2025 treasury withdrawals. Five options are currently up for voting by DReps. Option E - putting all 39 proposals and their associated withdrawals up front - quickly became the most talked-about and leads the poll (39 of the 87 votes cast at time of writing). Some questioned why it was offered at all, given concerns about Intersect’s ability to facilitate it. The poll is open until Tuesday 10th June at 23.59 UTC

This poll surfaced a few key tensions:

What exactly is Ekklesia for - signalling or steering?

What role should Intersect play - coordinator, facilitator, or something more decisive?

Is off-chain coordination clarifying the path - or muddying it?

It’s understandable if you’ve found this confusing. Many DReps reported that the real issue wasn’t the options - it was the lack of clarity around how to engage. Intersect’s stated aim was to simplify decision-making and build alignment before on-chain votes. But some feel that wasn’t clearly communicated. The inclusion of Option E, without context or support plans, created mixed signals. That doesn’t make DReps defiant. It points to a process that’s still taking shape.

We know this moment comes with baggage. Some will say this newsletter is soft on Intersect. Others may say it’s unfair to unduly criticize a process that continues to evolving. Either way, we’re all still learning and we’re here to lay out the facts - so you can judge the signals for yourself.

🗓 X Space: The Road Ahead – Intersect on Funding, Governance & Cardano’s Future

🗓 June 6th X Space hosted by @IntersectMBO

🎧 → Listen | 📄 → Transcript

Why listen?

Last month, DReps submitted a ₳275M budget info action, as required by the constitution to further ratify the amount that DReps has suggested they would support by voting on 39 budget proposals via the Ekklessia tool. That vote doesn’t actually release funds - it is a constitutionally required signal to proceed, not an approval. The next step is deciding how to structure the actual Treasury Withdrawals. To prepare for that, Intersect launched a (non-binding) poll on Ekklesia asking DReps to indicate how they want withdrawals structured.

How do you want Treasury Withdrawals structured?

The goal is to balance three things:

How much granular discretion DReps have in approving spending

Provide vendors clarity on their funding runway

What Intersect can realistically manage from an operational point of view

This poll also serves to clean up earlier confusion. Ekklesia wasn’t clearly framed as a coordination layer - intended to assess initial consensus - so many DReps were unclear on what they were signaling. The result was ambiguity. This vote is about clarifying intent before anything moves on-chain. This was Intersect’s clearest attempt yet to clarify how the ₳275M budget info action moves from signal to spend - and how the current withdrawal vote on Ekklesia is more than logistics. It’s a test of governance UX, trust, and process clarity.

Understanding the Five Withdrawal Options

Jack Briggs outlined five potential withdrawal structures:

Single withdrawal (omnibus)

Two support brackets - proposals above 67% and between 50%+1 and 67% (Single withdrawal for each)

Two support brackets - proposals above 67% and between 50%+1 and 67% (in two sets of withdrawals)

Five brackets by Ekklesia support -50-59%, 60-69%, 70-79%, 80-89%, 90-100% (in two sets of withdrawals)

39 Individual Withdrawals

The vote is advisory, not binding. But it gives Intersect a clearer signal on how much discretion DReps want - and how much complexity the ecosystem is willing to manage. The 39-option offers granularity but creates too much operational burden; Intersect has said that vendors would need to submit their own transactions for Option E, 39 withdrawals. Intersect has also stated that its preferred options that benefit the ecosystem while reducing administrative burden are options B & C.

“The tricky one is the 39 withdrawals… that one we need to work through a little bit more because there is a deposit requirement that’s obviously quite large… We might need to phase how we do those… Ideally - again, this is an operational thing from Intersect - it is cleaner for us to have fewer withdrawals. If we have 39 [withdrawals] going over the course of two months, then we're starting projects at different times. And it does add complexity to our delivery assurance function as part of our role as an administrator.”

— @JBriggsLondon, Interim Executive Director, Intersect

Intersect as Administrator: Milestone-Based Funding

It is also important to note that once any project funding is approved, there are checks and balances in place to ensure the community is getting what it paid for. If Intersect proceeds with administering a group of proposals - as signalled in the budget info action - it will do so under traditional contracts and milestone-based oversight:

Vendors will submit monthly milestone reports

Milestones will be reviewed and publicly tracked

A smart contract system (via Sundae Labs and Xerberus) is being phased in

Intersect will pilot the system first, then extend it to vendors over time

“We’ve already processed 294 milestones and are scaling our assurance team to match.” - Jack Briggs

💡 All approved proposals, whether withdrawn individually or as part of a grouped structure, are subject to milestone-based contracts. Vendors must meet agreed deliverables before any funds are disbursed. If a team doesn’t hit its targets, the remaining funds are not released. This system is designed to reduce risk while still giving builders a fair opportunity to deliver. It’s a safeguard that ensures ecosystem funds are earned through actual progress - not just promises.

To support transparency, xerberus.io is building a public dashboard where DReps and community members can monitor milestone approvals, disbursements, and delivery status - helping governance scale without centralizing trust.

Community Signal — and the Limits of the Poll

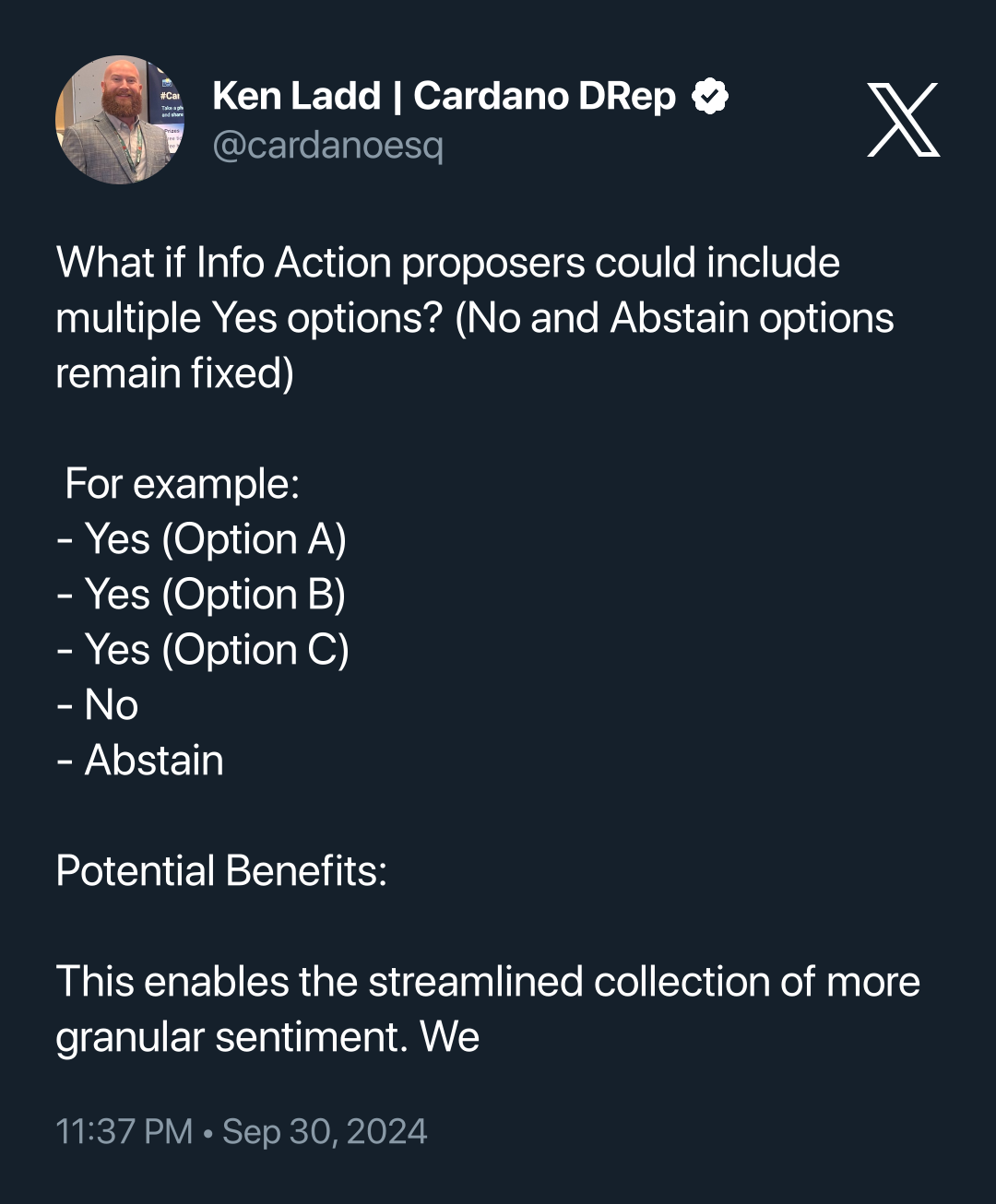

Some DReps, including Ken Ladd and Johnny Kelly, pointed out a key limitation in the current voting mechanism at the end of 2024:

DReps could only vote for one option, not rank them or support multiple acceptable outcomes.

Ken Ladd shared a suggestion on X for enabling multi-option Yes voting, which would allow more granular sentiment collection. In this system, DReps could signal all withdrawal structures they find acceptable - not just their top choice.

“If you’re in a community and picking several options, asking for all the OKs is better than voting once.”

The nature of consensus is not about everybody getting exactly what they want. But rather, aligning on a decision that as many people as possible can at least live with. Going forward, this mindset will be key to Cardano moving forward if we want to harness our decentralized skill sets and avoid getting caught up in contention or decision paralysis.

This video is a nice short reminder of why multi-option voting is useful when trying to reach an acceptable path forward among multiple stakeholders. This newsletter’s aim is to present all the signals and structural choices clearly- not to imply consensus where there isn’t one, and not to ignore momentum where it does exist. Option E may be leading, but it’s not unanimous - and the tooling design itself shapes how sentiment is recorded.

Charles AMA: Executive Function in a Decentralized System

🗓️ June 8th AMA with Charles Hoskinson

🎧 [Click to listen to full AMA]

Charles Hoskinson reflected on Cardano’s evolving governance architecture, stating that while strong legislative and judicial branches are now in place, the ecosystem lacks a functioning executive branch -resulting in roadmap confusion, budget friction, and diluted strategy.

Key Insight

“We reduced the power of the executive function dramatically… now we don’t have a recognized executive branch in the Cardano government. That’s why it’s hard to set roadmaps, define KPIs, or pursue strategy.” — @IOHK_Charles

He noted that various groups -IO, Intersect, the Foundation - each have their own roadmap, which fragments governance. However, he emphasized this is not failure but evolution, and the next step may involve reintroducing executive function through consent-based delegation.

“Just maybe, we need to start adding some executive function back in… and that’s okay—so long as it’s delegated with consent from the legislative and judicial branches.” — @IOHK_Charles

Why It Matters

This is the clearest public acknowledgment of why roadmap alignment has been so difficult: Cardano has no executive function. It exposes a core design challenge - how to enable strategy and execution without recentralizing control. Charles signals that the community may need to delegate limited authority if it wants coherent, forward motion in 2026.

🗓 X Space: Budget Spotlights – Haus, NFT CDN & Event Pavilions

🗓 June 3rd X Space hosted by @cryptstitution

🎧 → Listen | 📄 → Transcript

Why listen?

This Space showcased three proposals from the ₳275M budget info action that have majority dRep support but limited public visibility. Each one tackles a different part of the ecosystem stack - infra, real-world assets, and ecosystem presence. With treasury withdrawals coming soon, these spotlights are a chance to hear from the people behind the proposals—and understand what Cardano would actually be funding.

🌐 NFT CDN: Infrastructure-as-a-Service

Proposal: ₳600K to make Cardano’s NFT delivery infrastructure free to use for 18 months

Pitch: Remove paywalls for developers, support ecosystem-wide asset rendering, explore long-term sustainability

Traction: Used by Pool.pm, Eternl, and major projects; 8.8B API calls since 2022 with 100% uptime

Model Options: Treasury acquisition, open-source, or decentralized version

Takeaway: Treating backend infra as a public good—not a SaaS business.

“It took us $100K and nine months to build this. Now we want other devs to get that value from day one—free.” — Rocky (NFT CDN) @SmaugPool @nftcdn_io

🏠 Haus: Real Estate Tokenization

Proposal: Migration of $20M TVL and 36 deals from private Ethereum chain to Cardano

Pitch: Open-source tokenized home equity platform, with 5% profit-share to the Cardano treasury until the funding is repaid

Why Cardano? Gas costs, better ecosystem alignment, and a path to long-term scale

Takeaway: A Cardano-native entry into the $17T real estate market - and a test case for RWA credibility.

“We built this with $1,000 and two suitcases. Now we want to bring it to Cardano and give back.” — @dt_siddharth @haus

🏛️ Cardano Pavilions: Visibility at Events

Proposal: Host 10 coordinated Cardano booths at major events, lowering cost per project

Pitch: Shared space, project curation, pre-event strategy, and better Cardano visibility

Cost Model: ₳2,500 per project vs. ₳15–20K for solo booths

Takeaway: An ecosystem-wide marketing multiplier, especially for under-resourced teams.

“Everyone knows Cardano. They just don’t know who’s building on it.” - @invalid_eutxo @DiscoverCardano

📜 Yuta has a Constitution v2.0 in Development

YUTA (@yuta_cryptox) has released a draft of the Cardano Blockchain Ecosystem Constitution v2.0, with final feedback requested by June 16th at 00:00 UTC.

According to YUTA's announcement, key changes from v1.0 to v2.0 include:

Streamlined Process: YUTA claims removing Budget Info Actions will cut unnecessary off-chain budget processes that slow down DRep decision-making.

Enhanced Treasury Protection: YUTA states the draft maintains all existing safeguards from v1.0 including administrator requirements, independent audits, oversight metrics, dispute resolution, and Net Change Limits, while adding roadmap settings as requirements and flexible treasury withdrawal conditions.

Simplified Document: YUTA reports the word count has been reduced by 55% (from 3,082 to 1,385 words) while adding definitions and fixing formatting issues.

YUTA's draft aims to address governance friction points while preserving treasury security measures. DReps can review the full document and change log at the links provided in the announcement. → Full Constitution v2.0 Draft → Change Log

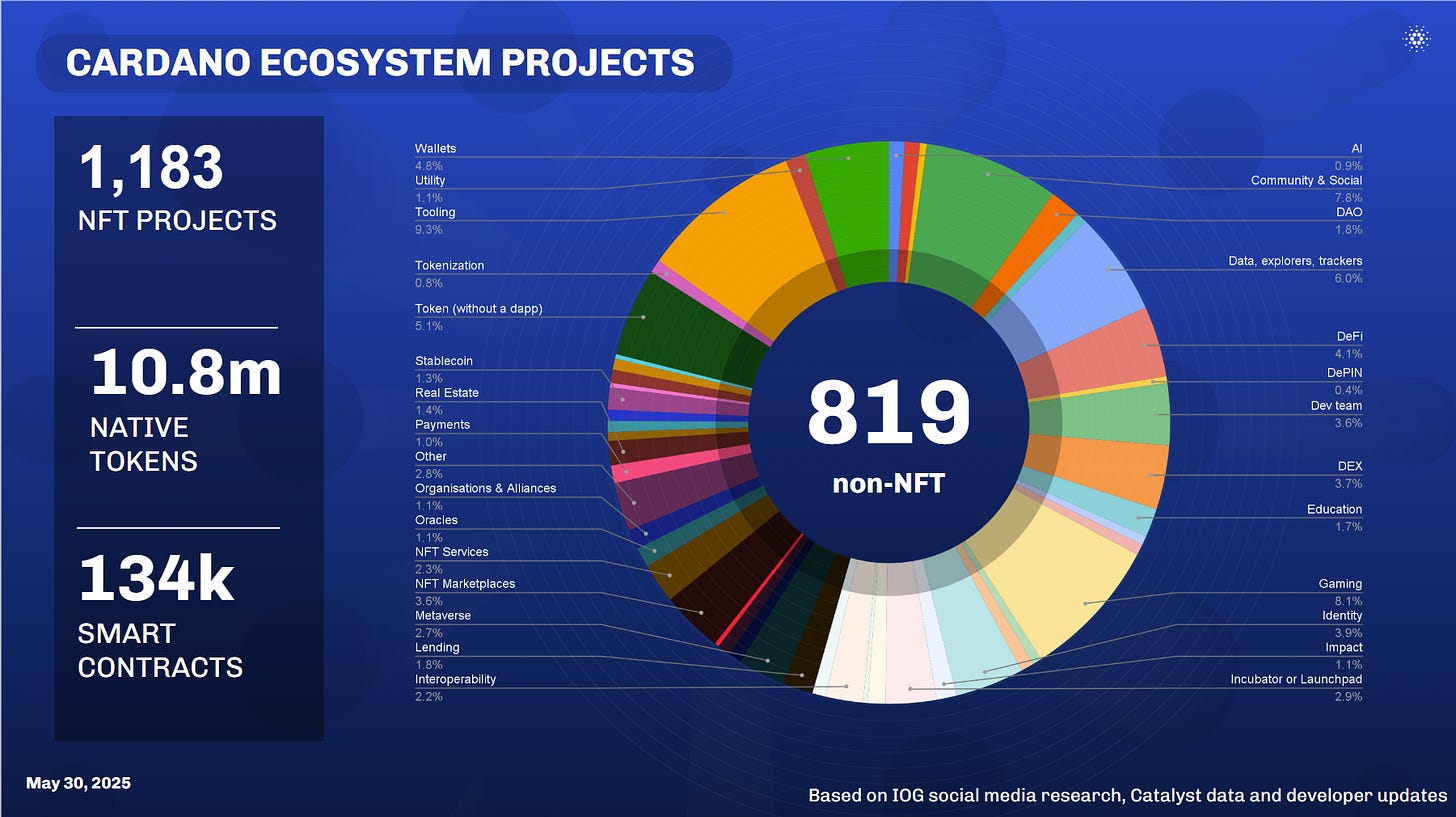

Project Ecosystem Updates

Check out the snapshot below for an updated overview of the current number of projects building on Cardano and when you can expect to see them launched:

Bitcoin Ordinals bridged to Cardano for the first time using BitVMX

The Catalyst interactive map highlighting funded projects went live this week

Cardano Foundation & UNHCR launched a world-first Crypto-Backed ETP for refugee aid

Tempo released a governance action dashboard that monitors voting results and allows for the creation of community polls.

Artifex Labs launched their first open source public project, Reverse DJED

Input | Output and Cardano Foundation both announced they will not be standing for re-election in the Constitutional Committee elections.

Thanks for reading. If you want to support our work in the DRep Forum please share this post!