☕ Freedom to Govern: DRep Dispatch, July 4th Edition

#4 Edition – July 4th, 2025 | A cup of fast, strong governance and budget intel—brewed especially for DReps.

Welcome

It’s been a minute! Great to have you back reading another edition of the DRep Dispatch. We’re not here to tell you what to think—just to help you stay up to speed on what others across the ecosystem are thinking.

TL;DR – Five Key Takeaways

Constitutional Committee (CC) Election Results: The election results are in, pending audit and official confirmation by DQuadrant. Intersect will formally announce the new CC on Sunday..

Intersect Activity Report for June 2025 by Adam Rusch has been posted and the Intersect Board Meeting minutes are now available. Intersect has advanced Cardano treasury governance by finalizing the budget process and developing a secure, multi-layered smart contract system for transparent treasury fund oversight. The organization also reinforced its legal foundation, expanded its Board ahead of Fall elections with new safeguards, and plans community engagement initiatives to uphold accountability and decentralized governance.

Cardano Sovereign Wealth Fund (CSWF) Proposal: Charles Hoskinson proposes evolving Cardano’s treasury from a passive ADA-only holding into an actively managed, multi-asset fund aimed at protecting value, increasing liquidity, and supporting ecosystem growth. DReps may soon vote on a $100 million pilot to initiate this transition—see full details below.

GovTool Platform Continuity: Recent updates improve user access and security, including simpler authentication and author verification. Although formal funding was not approved by DReps, Intersect’s interim director secured a short-term grant to maintain the platform, ensuring continuity but not replacing formal governance approval.

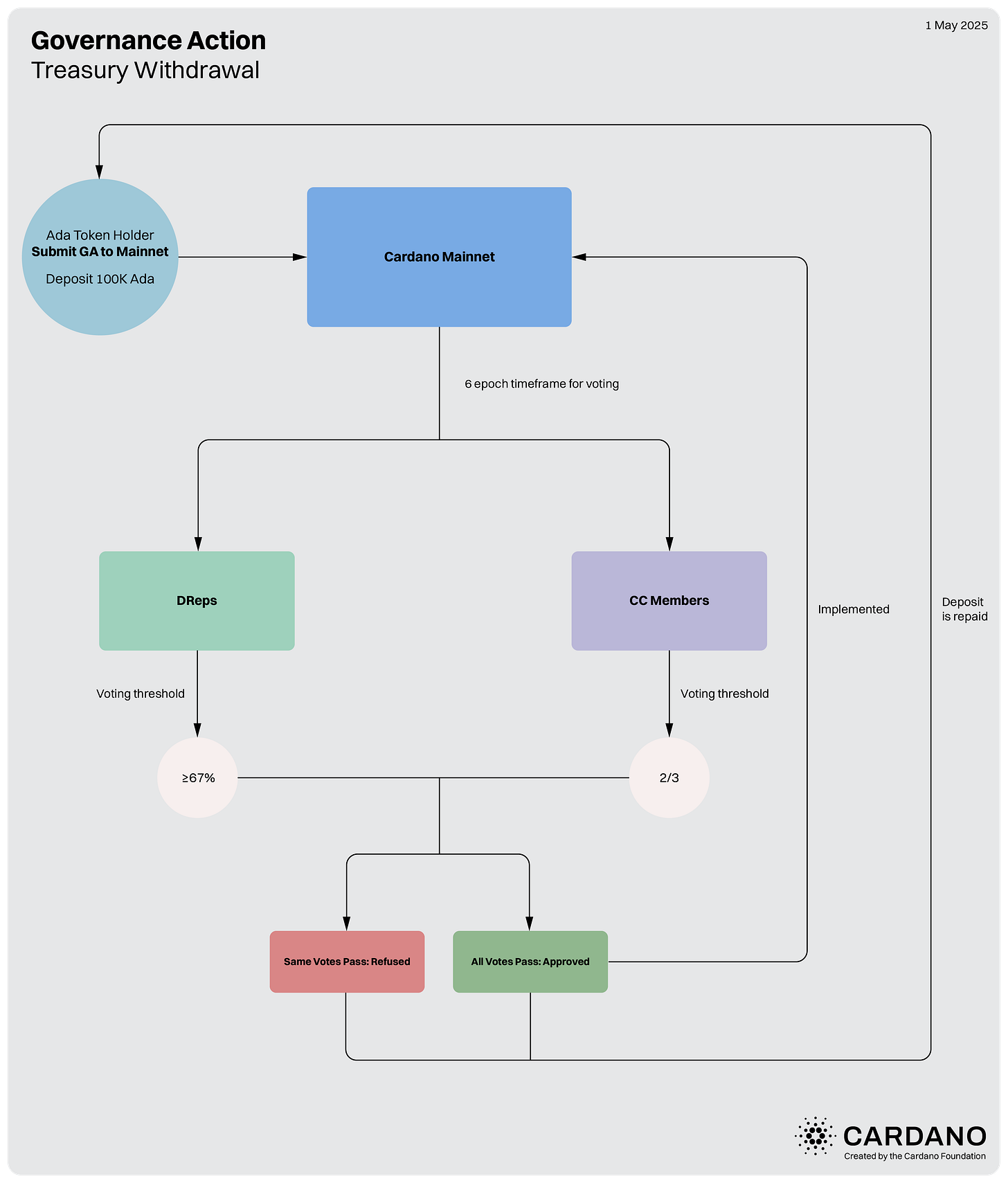

Shareables: The Cardano Foundation has published 14 clear, downloadable flow charts that break down how key governance actions are proposed, voted on, and approved. Example below.

Cardano Sovereign Wealth Fund (CSWF): Our Treasury Is Sitting Still While the Rest of the Industry Moves Fast. DReps Hold the Keys.

June 16th white board hosted with Charles Hoskinson

🎧 → Whiteboard Video | 📄 → Transcript

Charles Hoskinson has outlined a proposal for a Cardano Sovereign Wealth Fund (CSWF) in a recent whiteboard video. The aim: move from a passive, ADA-only treasury to an actively managed, multi-asset fund designed to protect value, build liquidity, and support ecosystem growth.

Cardano currently holds one of the largest treasuries in crypto –top 5 globally when including own tokens, according to DeFiLlama. The default ranking excludes native assets like ADA, favouring ecosystems that already operate multi-asset treasuries stacked with USDC and USDT. That’s something Cardano could address –if it shifts from passive holding to active deployment.

The CSWF proposal outlines a professionally managed structure that would diversify the treasury, seed stablecoin liquidity, support DeFi growth, and enable strategic partnerships with other ecosystems.

DReps may soon be asked to vote on whether to begin this transition –maybe starting with a $100 million pilot focused on stablecoin infrastructure

What’s the opportunity?

The CSWF would give Cardano access to the same strategic tools already in use across other leading ecosystems:

Diversify holdings to reduce exposure to ADA volatility

Deploy capital into stablecoins, DeFi, and Bitcoin to drive usage

Take positions in other ecosystems to support strategic alignment

Generate yield to grow the treasury or repurchase ADA

Signal operational maturity through active, accountable deployment

What’s the constraint?

Currently, none of that exists:

Unmanaged: The treasury holds 1.7 billion ADA and no other assets

Exposed: Spending power fluctuates entirely with ADA’s price

Inactive: There’s no mechanism for capital deployment or liquidity support

Outpaced: Other chains are already using treasury strategies to compete

“They don’t take $33 million in stablecoin volume issuance seriously. They don’t take 330 million TVL seriously.” - Charles Hoskinson, @IOHK_Charles

What do DReps Need to Consider?

Charles has proposed the idea of a $100 million stablecoin-focused pilot as a first step in activating a Cardano Sovereign Wealth Fund. If this moves forward, DReps may be asked to vote on whether to authorize it. Ecosystems are increasingly deploying capital to attract builders and grow liquidity. Cardano has the resources to participate—but currently lacks the structure to do so. The CSWF proposal is a test: not just of treasury strategy, but of Cardano’s capacity to act through governance.

Bitcoin DeFi: A Big Opportunity—If We Deploy Liquidity

🗓 June 17th recording hosted by @Andrew Westberg

🎧 Watch the full video | 📄 Transcript

Bitcoin DeFi could become one of Cardano’s most powerful growth engines—if there’s stablecoin liquidity to support it. DReps will have to vote on whether that infrastructure gets funded.

“None of this is going to work if you don't have stablecoin liquidity. There's so much money value locked up in bitcoin, if they bring their bitcoin over here and there's nothing to do, if there's no rides at the carnival, if there's no, you know, if there's nothing for them to do with their bitcoin, they won't ever bring it over.” - Andrew Westburg @amw7

What’s the opportunity?

Bitcoin DeFi demand is real—and growing:

Bitcoin holders want to borrow against BTC without selling, creating demand for stablecoin lending.

Major retailers are exploring stablecoins to avoid billions in credit card fees.

Cardano is building the necessary tech. Lace is integrating a Bitcoin bridge. BitVM is under exploration. But none of it matters if users can’t do anything once they arrive.

What’s the constraint?

Without stablecoin liquidity, Bitcoiners won’t bridge.

Algorithmic stablecoins lack the trust and off-ramp utility required for real-world usage.

Builders and users need fiat-backed coins like USDM or USDC to enable lending, payments, and ecosystem activity.

Decentralization Trade-Off: Liquidity vs Sovereignty

Fiat-backed stablecoins enable real activity, but the governance risks differ.

USDC and USDT are controlled by external issuers. In a fork, they choose which chain gets support—and which one loses liquidity. That gives off-chain actors decisive influence in on-chain outcomes.

USDM mints directly on Cardano and is designed to meet regulatory expectations while preserving chain-native control.

Upcoming funding proposals may favor adoption through these stablecoins. DReps will need to weigh immediate utility against longer-term resilience..

“Cardano is not guaranteed to win… if we don’t deploy this treasury in a way that brings real value to the ecosystem and increases transaction volumes, we may find ourselves in that situation of irrelevance.” - Andrew Westburg @amw7

What do DReps Need to Consider?

Proposals may soon be brought forward to deploy stablecoin liquidity—potentially through sovereign wealth fund–style structures. These decisions will determine whether Cardano invests in the infrastructure needed to support Bitcoin DeFi use cases. DRePs will need to assess whether stablecoin strategies are a priority for builder adoption, and what role treasury deployment should play in enabling that.

Leios and the Future of SPO Rewards. A real, testable path toward making SPO rewards sustainable.

🗓 June 10th X Space hosted by @cryptstitution

🎧 → Listen | 📄 → Transcript

How does the network pay for itself? Cardano’s stake pool operators (SPOs) secure the network, but their rewards currently come from a reserve that shrinks every epoch. Within 5–10 years, this reserve will no longer sustain current rewards, putting network security and decentralization at risk.

Leios is a proposed protocol upgrade designed to scale throughput dramatically– potentially to thousands of transactions per second (TPS)– while preserving decentralization. It restructures block production into an assembly line of parallel tasks that better use network and CPU resources, enabling many more transactions without compromising security.

To maintain economic sustainability, the network must reach a minimum throughput of roughly 50 TPS, the point at which transaction fees can fully support SPO rewards. Today, Cardano processes about 10 TPS, well below this threshold.

What’s the opportunity?

Leios can scale Cardano’s throughput much higher – to hundreds, potentially thousands of transactions per second (TPS), according to simulations.

This opens the door to ‘Visa-level’capacity while maintaining decentralization.

At a minimum, Leios aims to raise throughput to around 50 TPS, the break-even point where transaction fees can sustainably cover SPO rewards as the current reserve dwindles.Higher TPS beyond that threshold means more fee revenue, more applications, and stronger network economics over time.

What’s the constraint?

Current network throughput hovers around 10 TPS, well below the sustainable minimum.

SPO rewards depend on a shrinking reserve that will run out in 5–10 years unless fees can fill the gap.

Scaling brings trade-offs: increased transaction latency (from ~20 seconds to 1–2 minutes), higher bandwidth and storage costs for SPOs, and bounded determinism introducing concurrency in transaction ordering.

What do DReps Need to Consider?

Leios requires DReps’ approval through Cardano’s governance process. This decision involves balancing technical trade-offs—like increased latency and higher operational costs—against the urgent need for a sustainable economic model that secures SPO rewards and network scalability.

Your vote will shape the network’s future: enabling higher throughput to support growing demand and fees, or risking a decline in SPO incentives that could threaten decentralization and security.

As one of the first major protocol decisions DReps will face, this vote sets a precedent for how infrastructure upgrades are governed going forward.

Constitutional Committee Election Results

The Constitutional Committee election results are in, with final confirmation pending audit completion by DQuadrant.

Why this matters

The first fully elected Constitutional Committee sets the tone for how the Cardano Constitution will be interpreted in practice. Their independence, engagement with the community, and decision-making style will directly shape all governance actions DReps participate in.

Final Committee Composition

Intersect has closed voting and shared the top 7 candidates along with their term preferences:

Two-year terms (4 seats):

Eastern Cardano Council (₳1.06B voting power) - 7 members across Asia-Pacific

Ace Alliance (₳1.05B voting power) - 5 members with legal/technical expertise

Cardano Japan Council (₳992M voting power) - Regional representation

Tingvard (₳949M voting power) - Nordic consortium with engineering focus

One-year terms (3 seats):

Cardano Atlantic Council (₳1.87B voting power) - Current ICC members

phil_uplc (₳899M voting power) - Individual technical expert

KtorZ (₳821M voting power) - Individual protocol developer

Consortiums won six of the seven seats, indicating that DReps prefer groups with a range of perspectives and collective decision-making over individual candidates. These groups represent different regions and bring varied governance approaches from across the world.

The two individual winners are well-regarded technical experts, showing that DReps also value deep blockchain knowledge alongside governance experience. Throughout candidate discussions, all confirmed that Constitutional Committee members decide on constitutionality, while DReps assess merit and community benefit –preserving a clear separation of roles within governance.

Matthias, @_KtorZ_ on interpretation and ambiguity:

“When we have a disagreement, that’s a sign that the constitution is ambiguous and we should strive to improve it... We are the human complement of the constitutional guardrails... We interpret with some flexibility, but disagreements mean the constitution needs clarity.”

Intersect 3-Part ‘Meet the Candidates’ Series

🗓 June 27th X Spaces hosted by @IntersectMBO

These X Spaces provide an inside view of candidates competing to form Cardano’s first fully elected Constitutional Committee, a key group responsible for upholding the blockchain’s governance rules. The candidates, ranging from individuals to multi-member consortiums, discussed how they interpret the constitution, manage conflicts, and handle community engagement.

The sessions reveal key challenges, like deciding who should vote in governance—just delegated representatives or all ADA holders—and how to keep the process transparent and fair. Candidates also talk about how they’ll communicate decisions that might not be popular but are necessary under the constitution.

Anyone interested in the nuts and bolts of Cardano’s governance will find this a valuable look at the trade-offs and responsibilities these candidates face, and why voting in this election will influence the chain’s future governance structure.

Part 1 → 🎧 Listen | 📄 Transcript

Part 2 → 🎧 Listen | 📄 Transcript

Part 3 → 🎧 Listen | 📄 Transcript

GovTool Feedback & Sustainability Update

🗓 June 20th X Space hosted by @IntersectMBO

🎧 → Listen | 📄 → Transcript

Why this matters: Why this matters: GovTool is a core governance platform used by DReps and the wider Cardano community. Recent updates have addressed key user experience issues, improving accessibility and security for governance participation.

Sustainability Grant & Builder Commitment: Although DReps did not approve formal funding for GovTool, Jack Briggs, interim director at Intersect, has arranged a short-term sustainability grant to maintain platform continuity. This grant supports essential maintenance and incremental improvements while governance funding discussions continue. The GovTool team, including builders such as Lido Nation, Juno Stakepool, Byron Network, and WeDeliver, remains committed to ongoing support during this period of uncertainty.

Recent Improvements:

Simplified authentication, removing wallet validation barriers for browsing proposals

Added author verification on treasury withdrawal actions to prevent impersonation

What DReps need to know: The sustainability grant ensures short-term platform stability but is not a replacement for formal governance-approved funding. DReps and the community continue to evaluate funding proposals and provide feedback. Meanwhile, the development teams are focused on keeping the platform reliable and user-friendly.

Opportunity: Academic Research on Cardano Governance

Lamprini Georgiou, a PhD researcher at the University of Edinburgh, is studying digital trust, democracy, and blockchain governance through the lens of the Cardano Constitution.

Why it matters:

This research explores how blockchain governance systems establish democratic legitimacy and represent communities in decentralized environments. Insights from dReps’ real-world experiences will provide valuable data on how the Cardano Constitution functions in practice.

What this means for Cardano:

Academic attention validates the broader significance of Cardano’s pioneering governance model and may inform future improvements across blockchain ecosystems – and beyond.

How to participate:

DReps are invited to contribute by completing a research survey, helping bridge the gap between academic theory and governance in action.

Project Ecosystem Updates

Check out the snapshot below for an updated overview of the current number of projects building on Cardano and when you can expect to see them launched:

MuesliSwap launched MidStarterApp, an all-in-one ecosystem for Midnight projects built on Cardano

Voting in the Constitutional Committee election has officially closed, audit reports will be shared soon.

Flow DeFi announced their platform will support USDA when their mainnet is launched.

CTRL Wallet announced a partnership with Emurgo. Support for CNTs is already live with more features to follow

BTC Grow will be offering non-custodial BTC staking, powered by Cardano smart contracts. Testnet is expected to launch in July

Thanks for reading. If you want to support our work in the DRep Forum please share this post!